Energy tax credits targeting home improvements are a valuable way for homeowners to reduce their tax bill while making their homes more energy efficient. The recent Inflation Reduction Act has amended these credits to last longer and have a greater financial impact, which makes them even more appealing for homeowners who want to make eco-friendly upgrades to their homes.

The Energy Efficient Home Improvement Credit is one of the most significant changes to the tax credit system. The credit previously amounted to a lifetime credit of $500 through December 31, 2022, and had a different name, the Nonbusiness Energy Property Credit. However, the new credit is worth up to $1,200 per year for qualifying property placed in service on or after January 1, 2023, and before January 1, 2033. The new name for this credit is the Energy Efficient Home Improvement Credit.

The annual limit on the credit is an improvement on the previous lifetime limit. If homeowners spread out their qualifying home improvements over the 10-year life of the credit, they could receive up to $12,000 back on their taxes, compared to only $500 allowed under the previous credit. Qualified investments in heat pumps and biomass stoves and boilers can also earn homeowners an additional $2,000 per year.

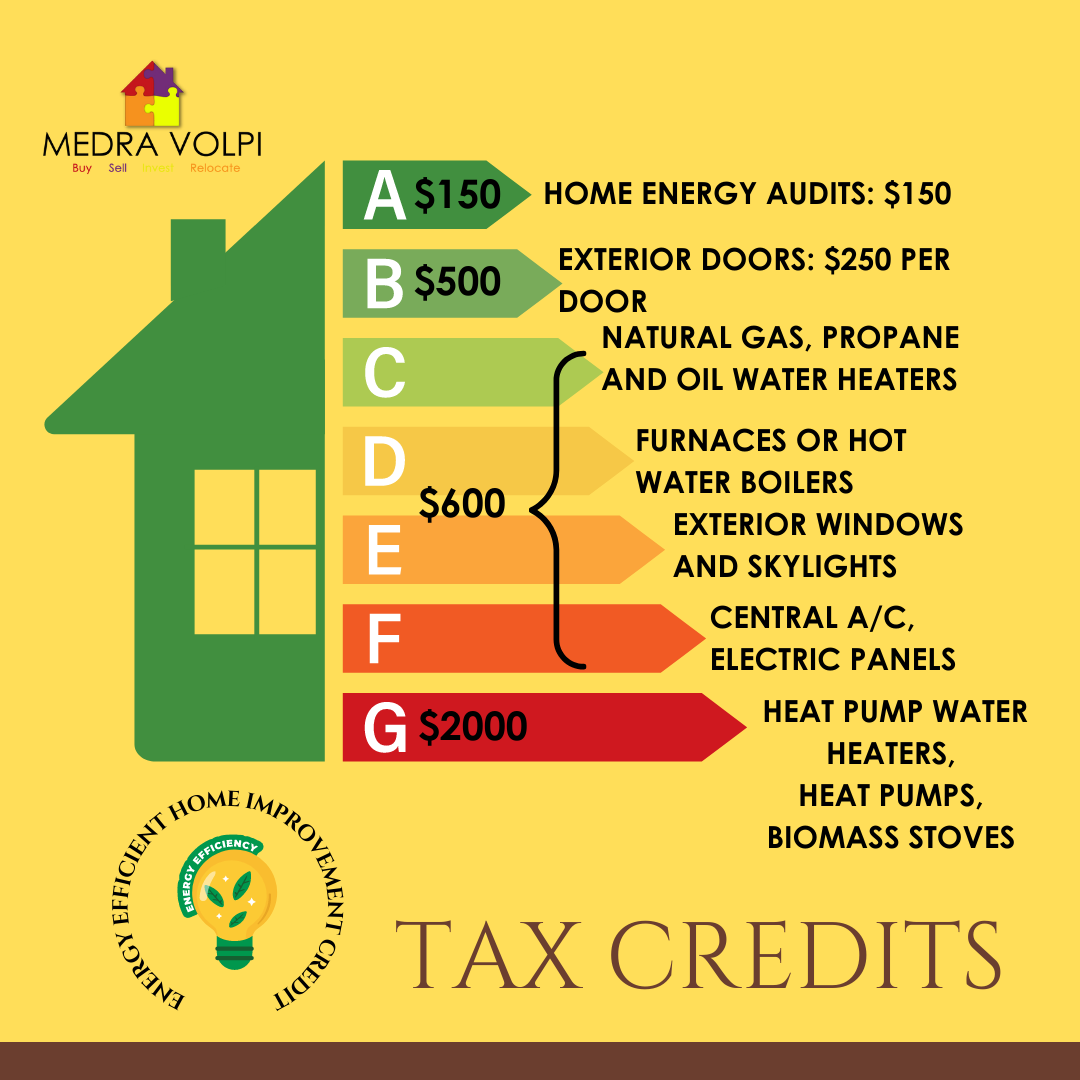

There are several home improvements that qualify for the Energy Efficient Home Improvement energy tax credit. Beginning January 1, 2023, the credit becomes equal to the lesser of 30% of the sum of amounts paid for qualifying home improvements or the annual $1,200 credit limit. Annual dollar credit limits apply to specific items, such as home energy audits, exterior doors, exterior windows and skylights, central A/C units, electric panels and related equipment, natural gas, propane and oil water heaters, furnaces, and hot water boilers. The separate aggregate yearly credit limit of $2,000 applies to electric or natural gas heat pump water heaters, electric or natural gas heat pumps, and biomass stoves and biomass boilers. This means homeowners can claim a maximum total yearly energy efficient home improvement credit amount up to $3,200.

In conclusion, the Energy Efficient Home Improvement Credit is an excellent way for homeowners to reduce their tax bill while making their homes more eco-friendly. By taking advantage of this tax credit, homeowners can make energy-efficient upgrades to their homes and earn credits for doing so. With the Inflation Reduction Act expanding the credit’s lifetime and financial impact, homeowners have more incentive than ever before to take advantage of these tax credits.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link