As we navigate through 2024, the Denver Metro housing market continues to exhibit unique trends that set it apart from national averages. Recent data from the Federal Housing Finance Agency (FHFA) indicate noteworthy shifts, and while no one can predict the future with absolute certainty, insights from experts provide a well-rounded forecast for 2025. Here’s what Denver area homeowners and prospective buyers can expect.

A Look at the National Context

Nationally, the FHFA Housing Price Index shows an average increase of 6.6% from Q1 2023 to Q1 2024. Remarkably, while most of the U.S. saw varying degrees of price increases, Washington, D.C., experienced a decline, and Vermont led with a striking 12.8% rise. This sets a broad context within which the Denver market operates.

Denver’s Market: Steady Growth Amidst National Fluctuations

Zooming into the Denver Metro, the scenario slightly deviates from the national average. Denver experienced a 4.2% increase in home prices year over year through the first quarter of 2024. Although this increase is more modest compared to areas like Vermont, it is significant in signaling steady growth in the region’s housing market. This growth comes despite mortgage rates lingering near 7%, challenging yet not deterring serious buyers.

Why it Matters: For homeowners, the steady appreciation means continued equity growth. For potential buyers, the escalating prices represent a challenging but not insurmountable market condition. The key takeaway? Denver’s market remains resilient.

State and Local Dynamics

Statewide, Colorado saw an average home value increase of 3.6%. The relatively modest growth compared to the national average reflects specific local factors impacting the market, including low housing inventory and economic conditions that differ from the broader U.S. economy.

Local Insights: Denver’s Real Estate Resilience

Despite mortgage rates lingering near the 7% mark, home prices in Colorado’s largest metro area show no signs of falling. This resilience in the Denver housing market is good news for current homeowners but presents challenges for prospective buyers who are waiting on the sidelines, hoping for prices to drop.

Zooming into Denver-specific data, the first quarter of 2024 compared to the last quarter of 2023 reveals significant insights. Active listings in the Denver metro were up by 31% in May, yet pending sales and home prices have remained steady year-over-year. This increase in inventory is somewhat relieving the intense competition among buyers, albeit slightly.

The Influence of Mortgage Rates and Market Predictions for 2025

Mortgage rates have played a pivotal role in shaping buyer behavior. With many sidelined due to high rates, the market has seen less competition, potentially giving current house hunters better bargaining power. However, this scenario is predicted to shift. According to market analyst Schlichter, “All signs seem to be indicating we’ve already peaked for the year,” suggesting that for now, Denver buyers might have a slight edge over sellers.

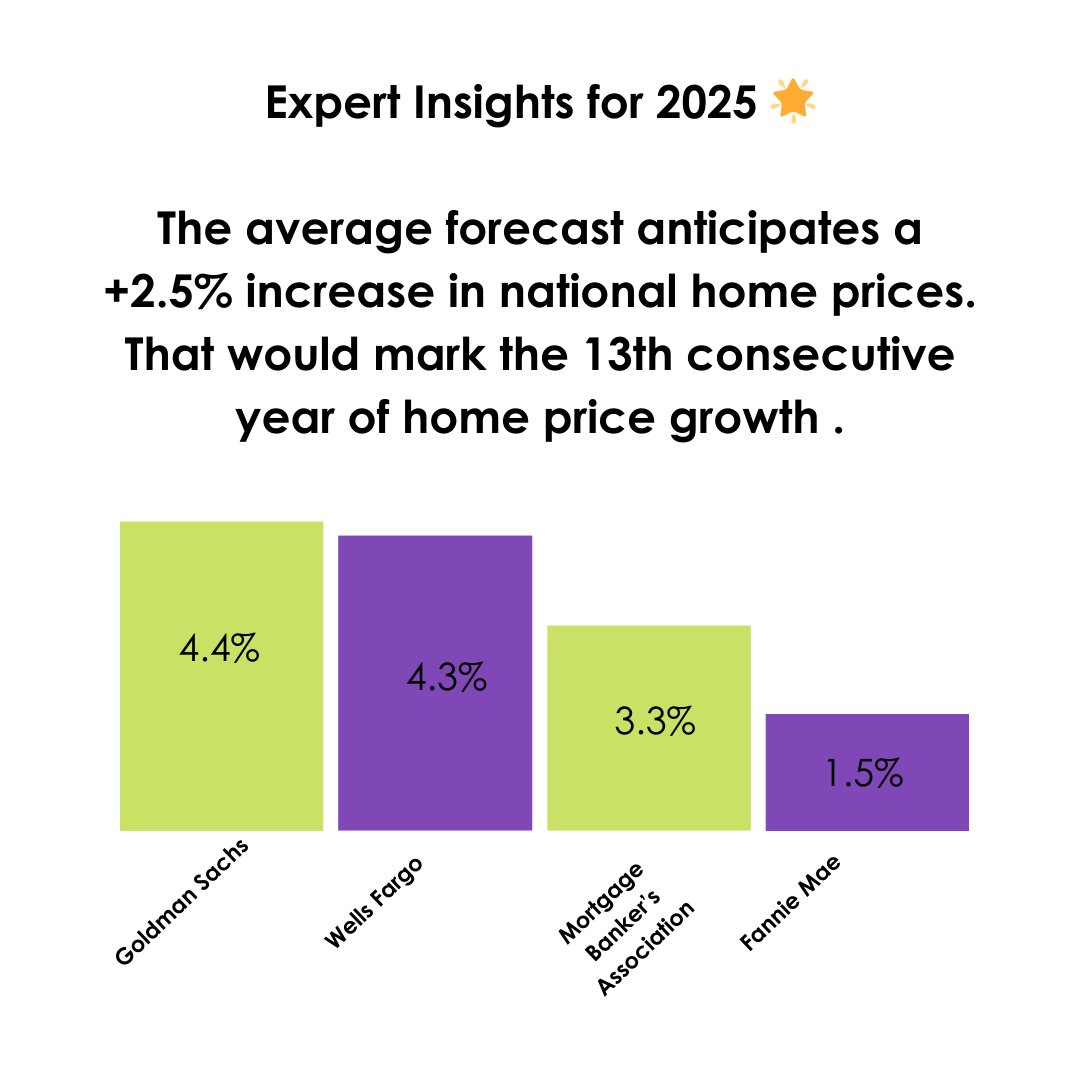

Looking ahead to 2025, while the Denver market might not mirror the national average exactly due to its unique local factors, predictions from major financial analysts range broadly. Here’s what some are forecasting for national home price growth, which could influence Denver’s market:

-

Goldman Sachs: +4.4%

-

Wells Fargo: +4.3%

-

Mortgage Bankers Association: +3.3%

-

Fannie Mae: +1.5%

These figures suggest a trend towards moderation in price increases, rather than a decrease, aligning with the slowdown in national housing market growth.

The Big Picture for Denver: Low Inventory Drives Prices

The Big Picture for Denver: Low Inventory Drives Prices

Low housing inventory continues to be a significant driver of price increases in Denver. According to FHFA’s Anju Vajja, this scarcity is a crucial factor keeping prices buoyant. With active listings in the Denver metro up 31% as of May 2024, and pending sales and home prices holding steady, the market dynamics suggest a balancing act between supply and demand.

Future Outlook: What to Expect in 2025

Looking towards 2025, the predictions for home prices reflect a market that is adjusting to economic pressures but still offers opportunities. The modest yet steady price growth in Denver positions it as a market that rewards informed and strategic buying and selling. Buyers might currently find themselves with a slight edge due to higher mortgage rates reducing competition. However, this could swiftly change with shifts in mortgage rates or economic policies.

For Sellers: The current market may not be fetching multiple over-asking offers as in previous years, but well-priced and well-presented homes continue to attract buyers. The key is understanding market timing and buyer sentiment.

For Buyers: The landscape presents a nuanced opportunity—prices are not dropping significantly, but less competition means more room to negotiate. Staying informed and ready to move quickly when the conditions align (such as a drop in mortgage rates) will be crucial.

Conclusion

As we edge closer to 2025, both buyers and sellers in the Denver Metro need to stay agile and informed. The market is characterized by gradual growth and evolving opportunities. Partnering with a knowledgeable real estate professional who understands the intricacies of both local and national trends will be more important than ever to navigate the complexities of buying or selling a home in these fluctuating conditions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link