There are plenty of reasons you might be considering selling your house right now. Whether you’re looking to relocate, downsize, or simply move closer to family and friends, one thing may be holding you back—affordability. With today’s housing market, that’s a valid concern. But before you start worrying too much, let’s talk about one critical factor that could make your decision easier: your home equity.

Understanding how much equity you’ve built up in your home could be a game-changer for your next move. Let’s take a look at two key factors that have a significant impact on your equity and why they matter.

1. How Long You’ve Owned Your Home

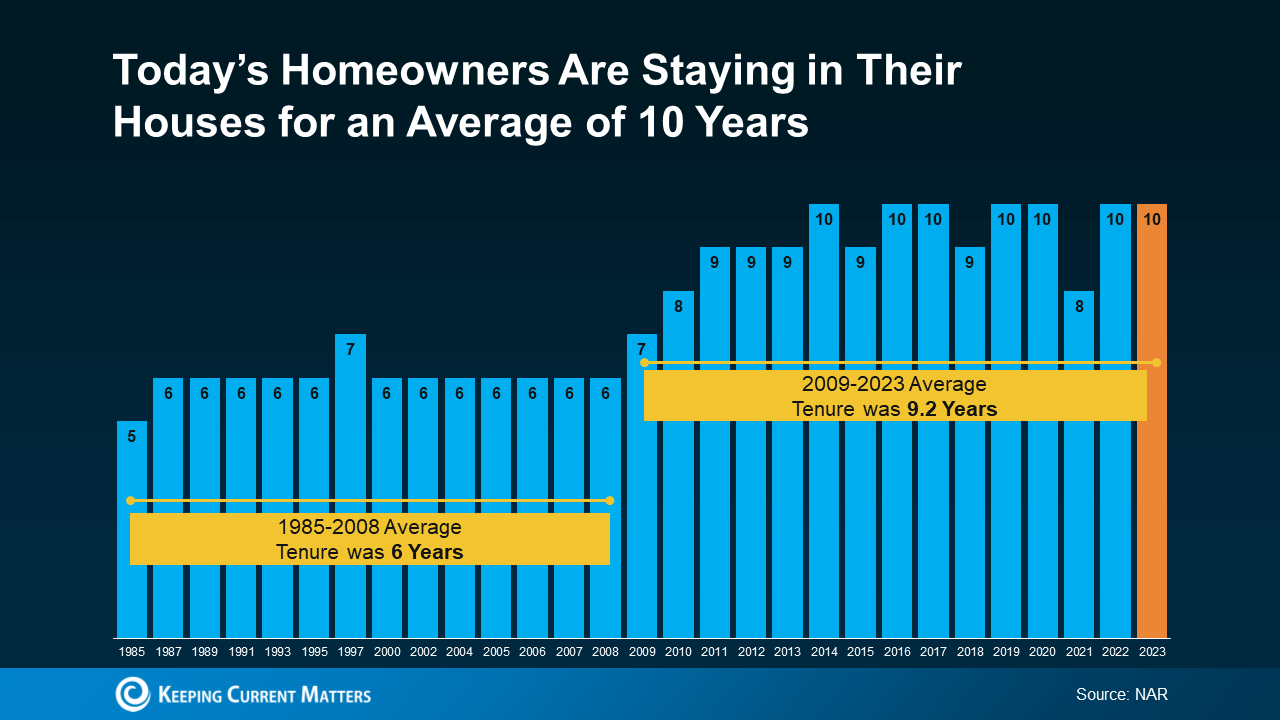

The first factor to consider is how long you’ve been in your home. Homeowner tenure (or how long people stay in their homes before selling) has shifted over time. According to the National Association of Realtors (NAR), the average tenure used to hover around six years from 1985 to 2009. But today, that number has jumped to about 10 years (see graph below).

Why is this important? The longer you’ve owned your home, the more equity you’ve likely built. You accumulate equity through two main avenues: by paying down your mortgage over time and by benefiting from rising home prices. Over a 10-year span, combining your mortgage payments with rising home values means you may be sitting on a considerable amount of equity.

2. How Home Prices Have Appreciated Over Time

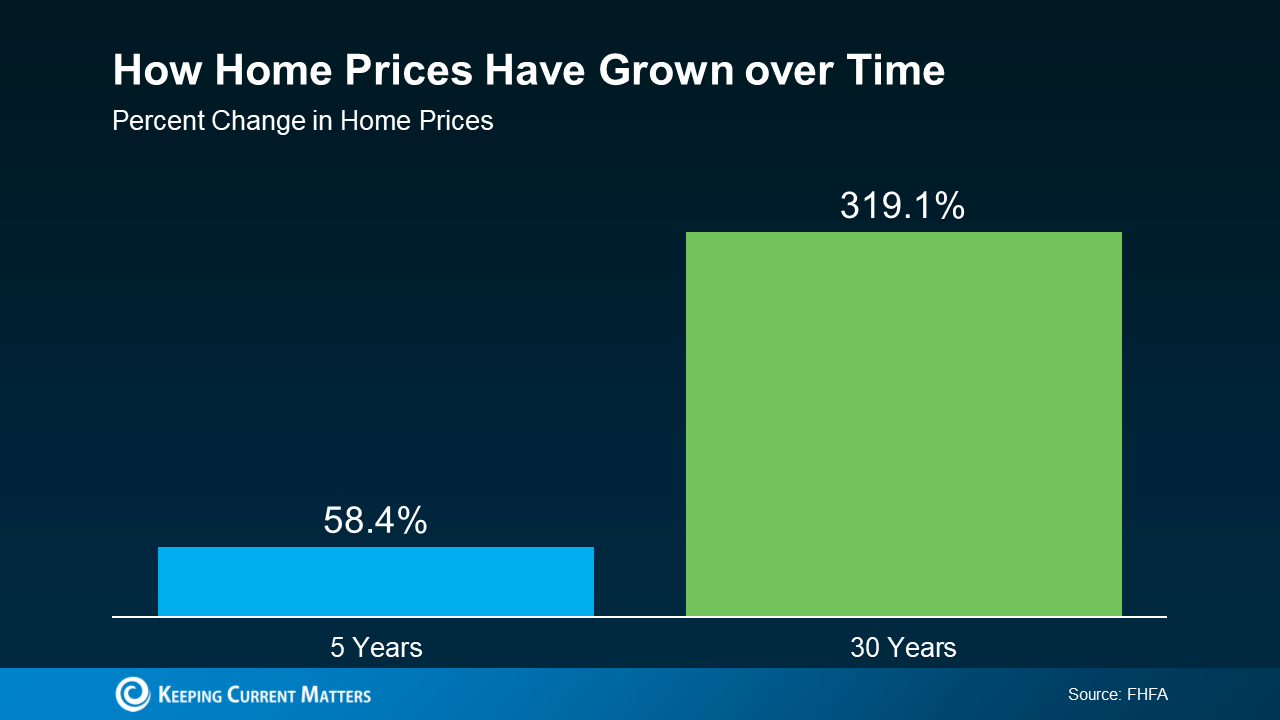

Home prices don’t just rise overnight—they appreciate over time. And if you’ve been in your home for at least five years, you’ve likely experienced this firsthand. According to data from the Federal Housing Finance Agency (FHFA), home prices have climbed significantly over the years (see graph below).

What does this mean for you? Let’s break it down:

- If you’ve owned your home for five years, the value of your property could have increased by almost 60%.

- And for homeowners who have stayed in their homes for 30 years, your home’s value may have tripled.

This kind of appreciation can be a powerful tool when it comes to buying your next home, especially if you’re looking to upgrade, relocate, or move closer to loved ones.

How Your Equity Can Impact Your Next Move

Regardless of your reason for selling—whether it’s for a bigger home, a change of scenery, or to be closer to family—your equity can make a huge difference. It can allow you to put a larger down payment on your next property, reducing your monthly payments. Or, it could help you afford that dream home in a new location.

Bottom Line

Your home equity is a major asset that can help you take the next step toward your real estate goals. If you want to know how much equity you’ve built up and how to use it for your next move, let’s connect. We’ll explore your options and make sure you’re making the most of your home investment.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link