Did you know that many homeowners are able to put more money down when they buy their next home? This often happens because they can leverage the equity they’ve built in their current property. By tapping into that equity, they’re able to make a larger down payment on their next purchase—and right now, that opportunity is greater than ever.

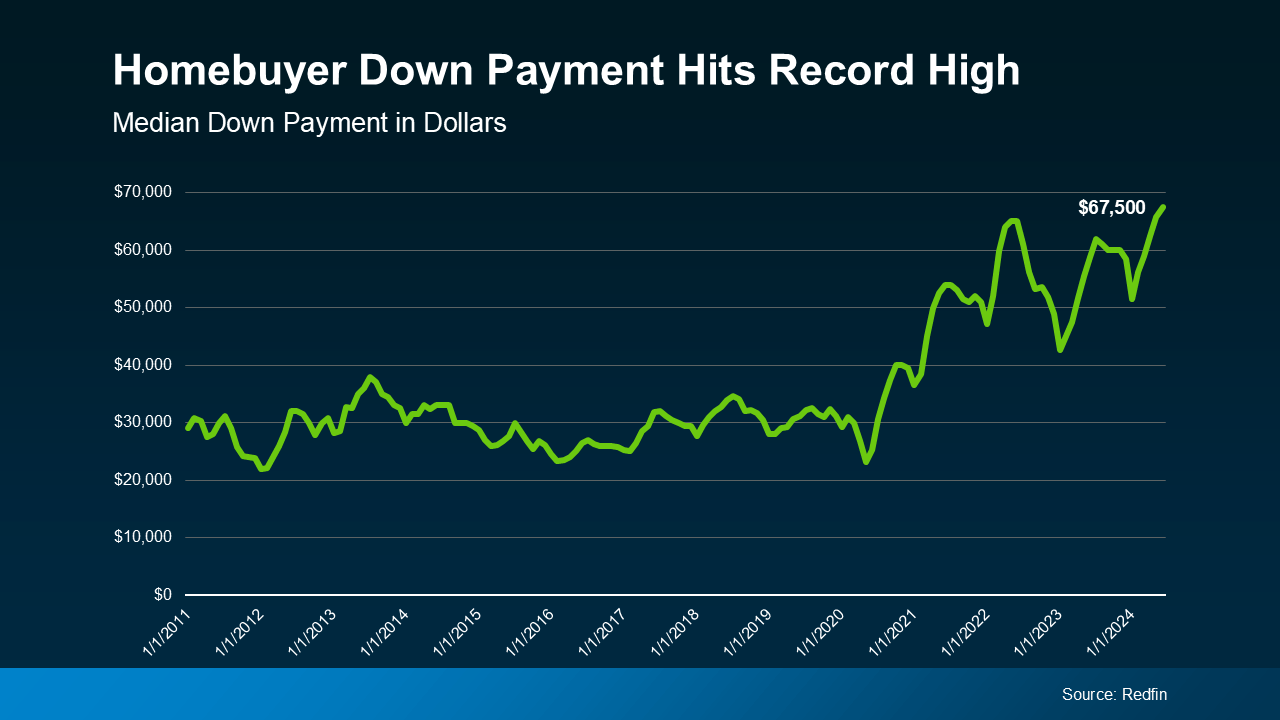

According to recent data from Redfin, the typical down payment for U.S. homebuyers has reached a record high of $67,500. That’s nearly 15% more than last year! And with home equity at an all-time high, it’s easy to see why this trend is gaining momentum.

How Equity Makes This Possible

Over the past five years, home prices have appreciated significantly, giving current homeowners a big boost in equity. This accumulated equity can be a game changer when you sell and move. By using those funds as part of your down payment on your next home, you’re not only increasing your buying power but also setting yourself up for some meaningful financial advantages.

The Perks of a Bigger Down Payment

Of course, you don’t have to put down a large sum when buying a home. There are plenty of loan programs that allow you to put as little as 3%—and sometimes even 0%—down. But many homeowners are opting to use more of their equity as a down payment for some very compelling reasons. Here’s why a bigger down payment can be a smart move:

1. You’ll Borrow Less and Save More in the Long Run

When you put more down, you reduce the amount you need to borrow. And the less you borrow, the less you’ll pay in interest over the life of your mortgage. This means significant long-term savings—money that stays in your pocket for years to come.

2. Potential for a Lower Mortgage Rate

A larger down payment often signals to your lender that you’re financially stable and present a lower credit risk. This could lead to a lower mortgage rate, allowing you to save even more. With a reduced rate, the cost of financing your home decreases, maximizing your savings.

3. Lower Monthly Payments

A bigger down payment doesn’t just reduce how much you borrow; it can also lower your monthly mortgage payment. This can make your next home more affordable on a month-to-month basis, providing more flexibility in your budget and less financial stress.

4. You Can Avoid Private Mortgage Insurance (PMI)

When you’re able to put down 20% or more, you can skip Private Mortgage Insurance (PMI), which is typically required for buyers with smaller down payments. As Freddie Mac explains:

“For homeowners who put less than 20% down, Private Mortgage Insurance, or PMI, is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

By avoiding PMI, you’re cutting out an additional expense from your monthly payments. It’s one less cost to worry about, making homeownership that much easier.

Bottom Line

With home equity reaching new heights, homeowners are in a unique position to make substantial down payments, which can lead to serious financial benefits. If you’re thinking about selling your current home and moving up, now might be the perfect time to make the most of your equity gains.

Let’s connect to discuss how much equity you have in your current home and explore how it can enhance your buying power in today’s market. Together, we’ll create a strategy that positions you for success in your next chapter.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link