If you’re in the market to buy a home in the Denver Metro area, chances are you’re watching mortgage rates closely. And if you’re like many buyers, you’re probably waiting for rates to drop to that magic number: 6%.

According to the National Association of Realtors (NAR), that’s the point where millions of buyers across the country say they’ll feel ready to jump in. But here’s the real question—are we on track to get there, and is waiting really the best strategy?

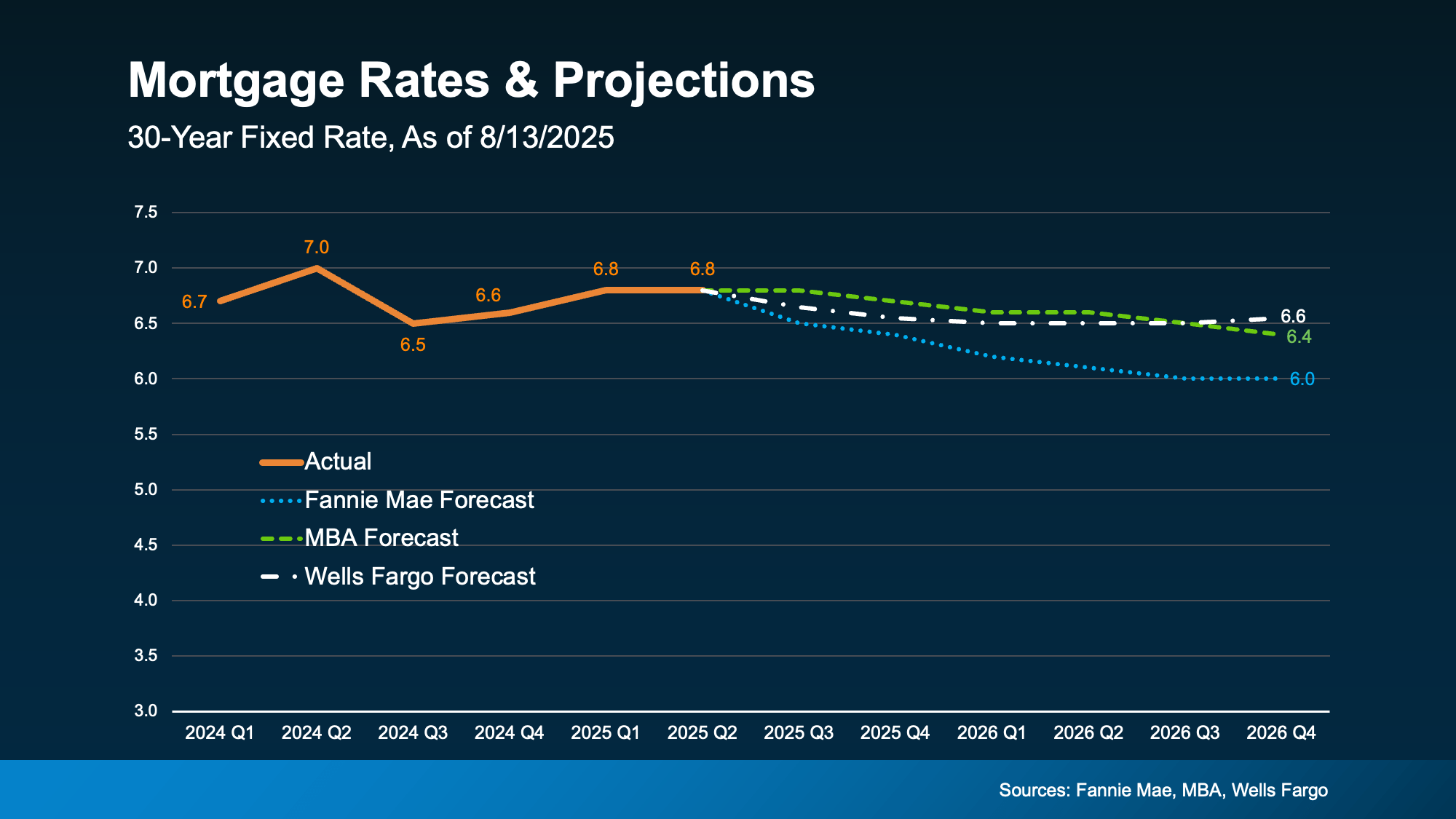

Where Rates Are Now—and Where Experts Expect Them to Go

Most forecasts say rates will hover in the mid-to-low sixes through the end of next year. After a weaker-than-expected jobs report this spring, rates fell to their lowest point so far this year at 6.55%, sparking optimism that bigger drops might be coming.

But experts caution that significant declines aren’t expected in the near term. Instead, we may see small, gradual shifts based on the next round of economic data.

So, while the dream of locking in exactly 6% feels within reach, it may not happen as quickly—or as dramatically—as many hope.

Why 6% Matters—and What Happens When We Get There

If rates dip to 6%, economists project it could unlock 5.5 million additional buyers nationwide. That’s an enormous surge in demand.

Here’s what that means if you’re planning to wait:

-

More competition: Instead of being one of today’s more strategic buyers, you’ll be shopping in a much more crowded market.

-

Less negotiating power: Sellers will have the upper hand again, making it harder to negotiate on price, concessions, or repairs.

-

Potential price pressure: Increased demand could drive home prices higher, offsetting any savings you might get from a slightly lower interest rate.

Why Buying Now May Be Smarter

If you’re financially ready, waiting for that magic number may actually cost you. Buying today means:

-

Less buyer competition in the Denver Metro market

-

More leverage in negotiations on price and terms

-

The chance to refinance later if rates drop further

In many cases, the monthly payment difference between 6.55% and 6% is relatively modest—especially compared to the higher purchase price or bidding wars you might face later.

Final Thoughts from Medra

Here’s the truth: timing the market perfectly is nearly impossible. What you can do is make a smart, informed decision based on your finances, your lifestyle, and today’s opportunities.

If you’re hoping to buy, and the numbers already work for you at current rates, waiting could put you behind thousands of other buyers when the floodgates open.

📲 Curious about whether it makes sense for you to buy now or wait?

Let’s talk strategy. I’ll help you weigh your options and put together a plan that fits your timeline—and your long-term goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link