Creating and maintaining wealth that can be passed down through generations is a goal for many families. Real estate has long been recognized as one of the most reliable and effective ways to build such wealth. Whether you’re a seasoned investor or a first-time home buyer, understanding the potential of real estate to grow your wealth is essential.

The Power of Home Equity Growth

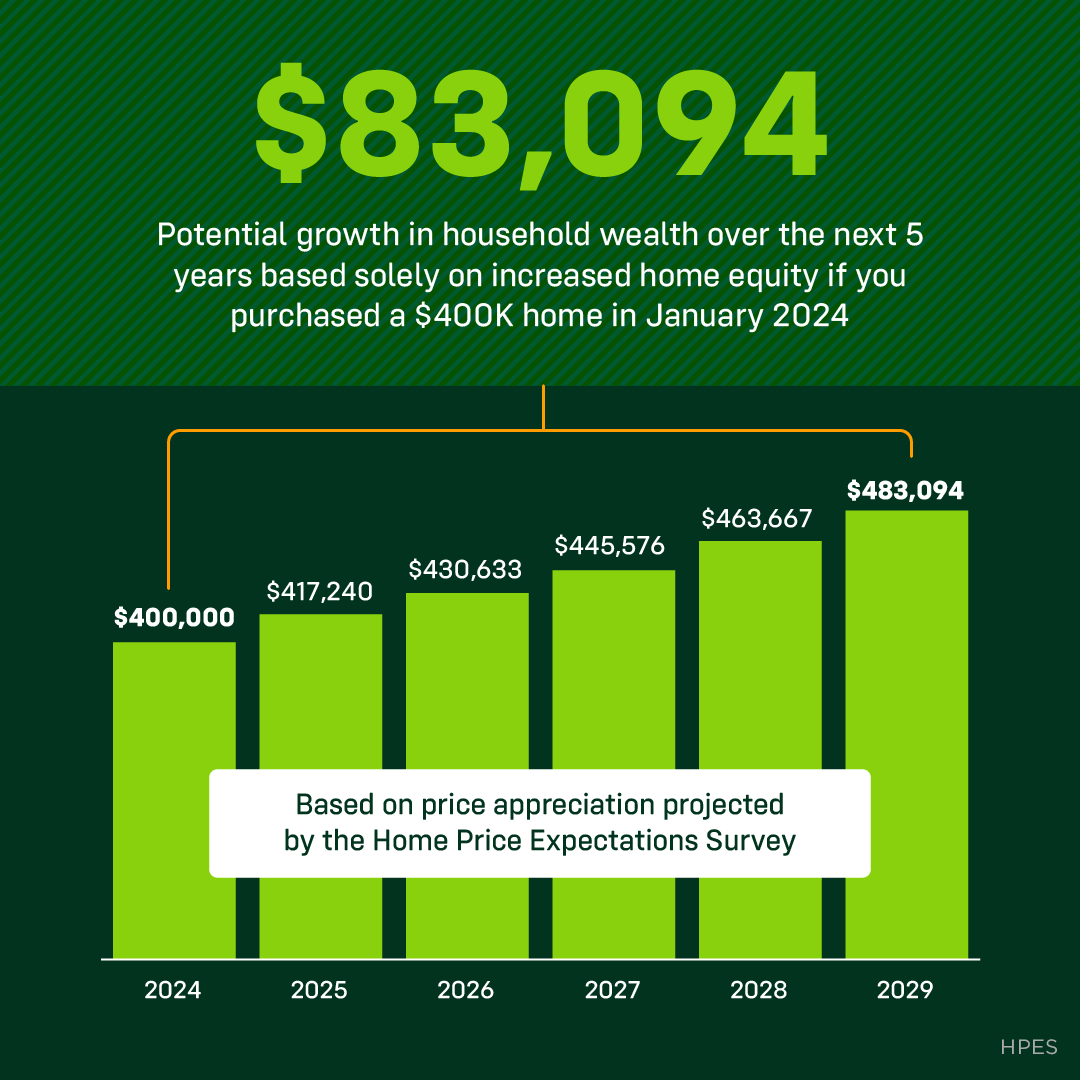

One of the most compelling aspects of real estate investment is the potential for home equity growth. Consider this: based on data from Keeping Current Matters (KCM), the potential growth over 5 years on home equity alone for a $400,000 home is an astounding $83,094. This significant increase underscores how property investment can be a cornerstone in creating long-term financial security.

Why Real Estate is a Strong Investment

- Appreciation Over Time: Real estate typically appreciates in value over time. Historical data shows that home values generally increase, offering a robust return on investment. This appreciation is a key driver of wealth accumulation for homeowners.

- Leverage: Real estate allows you to leverage your investment by using mortgage financing. By putting down a fraction of the home’s value, you can control the entire property and benefit from its full appreciation, amplifying your returns.

- Tax Benefits: Homeowners and real estate investors can take advantage of various tax deductions, including mortgage interest, property taxes, and depreciation. These tax benefits can significantly enhance your overall returns.

- Rental Income: For investors, rental properties can provide a steady stream of passive income. This income can help cover mortgage payments and other expenses, and even generate positive cash flow.

- Hedge Against Inflation: Real estate serves as a hedge against inflation. As the cost of living rises, so do property values and rental income, protecting your investment’s purchasing power.

Strategies for Building Generational Wealth

- Start Early: The earlier you invest in real estate, the more time you have for your property to appreciate. Even if you start small, the compounding effect over time can lead to substantial wealth.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying your real estate investments across different property types and locations can mitigate risks and enhance returns.

- Reinvest Profits: Use the income and profits generated from your real estate investments to acquire more properties. This reinvestment strategy can exponentially grow your portfolio and wealth.

- Focus on High-Growth Areas: Invest in areas with strong economic growth, good schools, and robust infrastructure. These areas are likely to experience higher appreciation rates, boosting your investment’s value.

- Plan for the Long Term: Real estate is a long-term investment. Be patient and avoid the temptation to sell prematurely. Allow your investment to mature and maximize its potential growth.

Considering an Investment Property for College?

One unique strategy to consider is purchasing an investment property for your college student to live in while attending school. Not only can this provide your child with a stable and potentially more cost-effective living situation, but it can also serve as an excellent long-term investment. Read more about this approach in my previous post on buying a property for your college student.

Making Informed Decisions

Whether you are buying your first home or adding to your investment portfolio, making informed decisions is crucial. Work with a knowledgeable real estate agent who understands the market dynamics and can provide valuable insights. Conduct thorough research and due diligence to ensure your investment aligns with your financial goals.

Conclusion

Investing in real estate offers a tangible and powerful means of building generational wealth. With potential home equity growth of $83,094 over 5 years on a $400,000 home, the benefits are clear. By starting early, diversifying your investments, and planning for the long term, you can create a legacy of financial security for your family.

Ready to explore real estate investment opportunities? Contact me today to learn how you can start building generational wealth through property investment.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link